BANKING RISK

MANAGEMENT SOLUTION

-

Complex risk control scenarios and inconsistent management

Bank risk control involves multiple scenarios such as anti-fraud and credit loans, and there are problems such as poor sharing of risk resources across channels, cross-business lines, and cross-department and decentralized management of risk scenarios.

-

Requirements for high performance, high concurrency, and low latency in wind control during real-time events

Event risk control needs to complete risk identification and early warning interception during the transaction process, which requires extremely high performance and stability of the risk control engine. The platform needs to have millisecond-level real-time monitoring, real-time decision-making, real-time warning, real-time notification and other functions.

-

Requirements for a complete and flexible rule monitoring and update mechanism

It is expected that the platform can carry out rule changes, rule configuration and hot deployment in a timely manner, continuously optimize rules and models, adapt to the rapid changes and upgrades of risks in real time, and solve the problem of risk management efficiency.

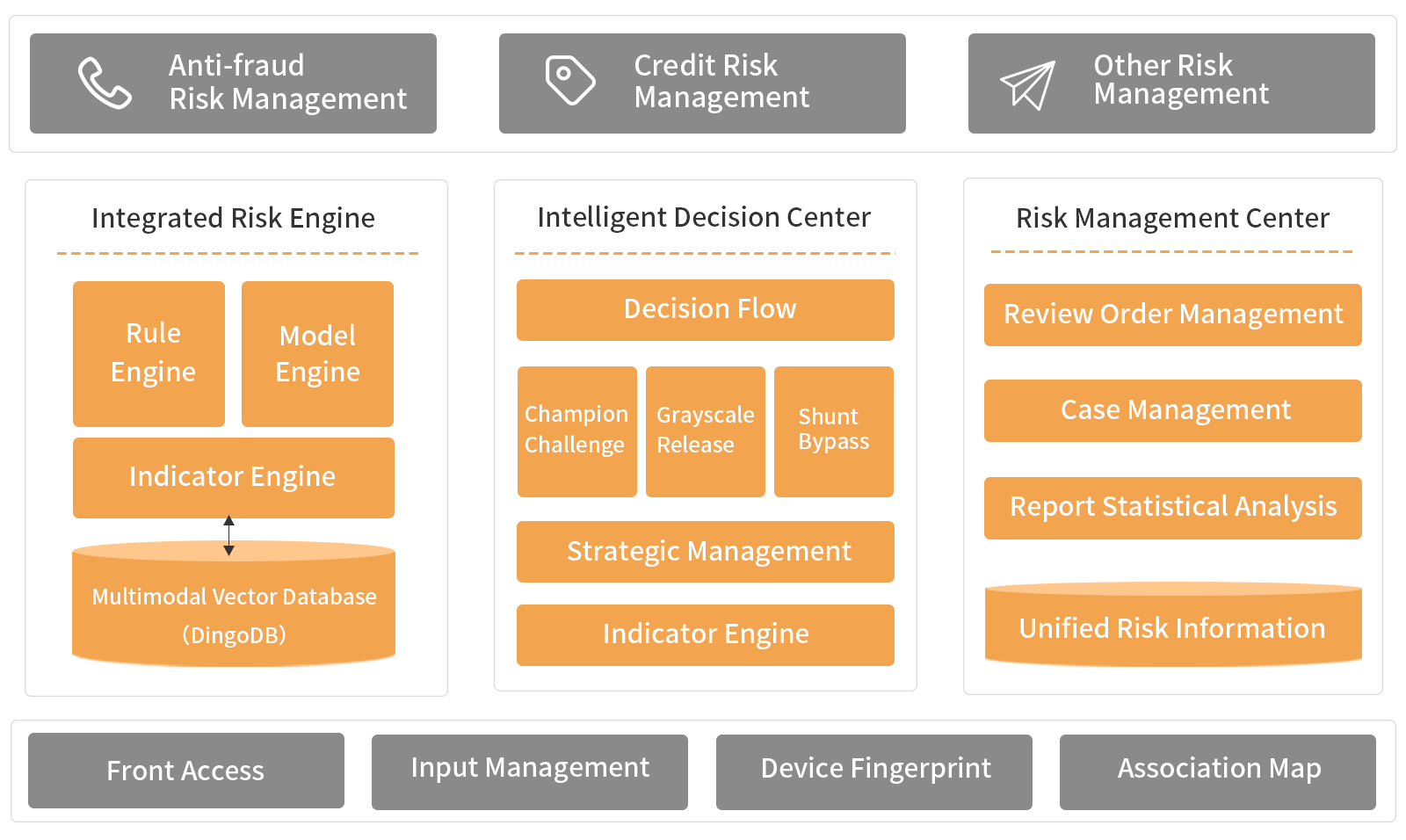

DataCanvas banking risk control solution integrates the in-depth understanding of customer risk control business model, combines our company's AI foundation software technology accumulation, and outputs a "one-stop" intelligent risk control middle platform solution consisting of core components such as "risk control engine, intelligent decision-making center, risk disposal center" to the banking industry.

This solution can simultaneously meet the needs of various risk control scenarios such as transaction anti fraud, application anti fraud, marketing anti fraud, and credit whole chain risk control, establish a real-time monitoring and post event analysis mechanism, and comprehensively build an enterprise digital risk defense line.

-

A systematic AI product with independent innovation

From the upper level risk control engine to the lower level indicator calculation database, all components are independently developed to fully meet the requirements of enterprise AI localization.

-

High performance risk control indicator calculation engine

Based on the self-developed industry's first open source storage, service, and integrated multi-mode vector database DingoDB, the underlying distributed indicator storage database is constructed to provide high-performance storage, computing and query services with free expansion and no node restrictions for real-time risk control.

-

Unified risk control center at the bank level

Integrating bank anti fraud, credit, and various risk control scenarios, providing unified risk indicator rules and model engines to meet risk control needs in various business scenarios.

-

Enterprise level underlying technology architecture with leading security performance

Support cloud native, adopt microservices architecture, and adapt to enterprise containerization needs; Distributed deployment, meeting the needs of enterprise data security and HA high availability, supporting tenant isolation and permission management in various complex scenarios.

-

Intelligent cloud native high-performance infrastructure

Intelligent cloud native high-performance infrastructure -

Create a unified risk control engine for enterprises

Create a unified risk control engine for enterprises -

Efficient enterprise level risk management

Efficient enterprise level risk management

- Try AIFS:AI Foudation Software & Services

- Hotline:+86 400-805-7188

- E-mail:contact@zetyun.com

- Join Us:hr@zetyun.com